washington state capital gains tax repeal

Jeremie Dufault R-Selah has introduced legislation that would repeal the states new controversial capital gains income tax that went into effect on Jan. Governor Inslee signed Washingtons new capital gains tax the tax or the CGT into law on May 4 2021.

Like Hollywood Washington State Can T Resist Its Sequels Puget Sound Business Journal

The bill is part of a multi-year push by the legislature to rebalance a state tax.

. In spite of the pandemic Washington state has a surplus in excess of 10 billion. The state of Washington enacted a capital gains tax on individuals who recognize gain from the sale of long-term capital assets. The legislature imposed without a vote of the people a 7 tax on capital gains in excess of 250000 with exceptions costing 5736000000 in its.

The repeal side of an advisory vote on a capital gains tax approved by the state Legislature is out to an early lead following Tuesday nights. IIB - Cash Receipt Impact None. While there currently isnt a capital gains tax should it.

The individual income tax combines a tax on labor income and a tax on capital income such as interest dividends capital gains and certain business profits In a non-binding advisory vote last week 61 of voters across the state said legislators should repeal the law. Washington Enacts New Capital Gains Tax for 2022 and Beyond. House Bill 1912 is a companion to Senate Bill 5696.

1 day agoThe measure simply put seeks to repeal any law in Washington state that imposes a capital gains tax. The state intends to appeal. Washington state voters overwhelmingly voted to disapprove of an excise tax on capital gains that takes effect in 2022.

House Bill 1912 has been referred to the House Finance Committee. Washington State Representative Jim Walsh R-Aberdeen issued the following statement on the. It just adds another layer.

This new tax could be especially impactful when considered alongside proposed federal capital gains tax rate increases. Although the ballot measure asking voters to recommend on retaining or repealing the new tax is purely advisory this gauge of voter sentiment could be particularly illuminating as. The capital-gains tax doesnt balance the tax code.

Voters responded to a nonbinding advisory question on the Nov. Does that justify a repeal of the capital gains income tax passed by majority Democrats in 2021. SB 5096 was designed to impose a 7 tax on capital gains over 250000 with certain exceptions.

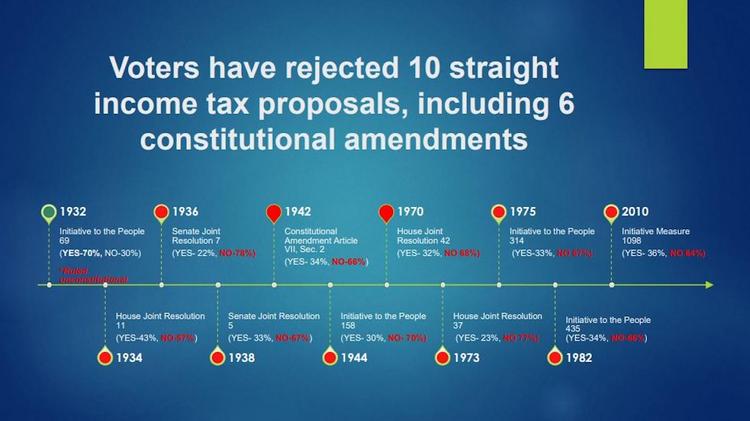

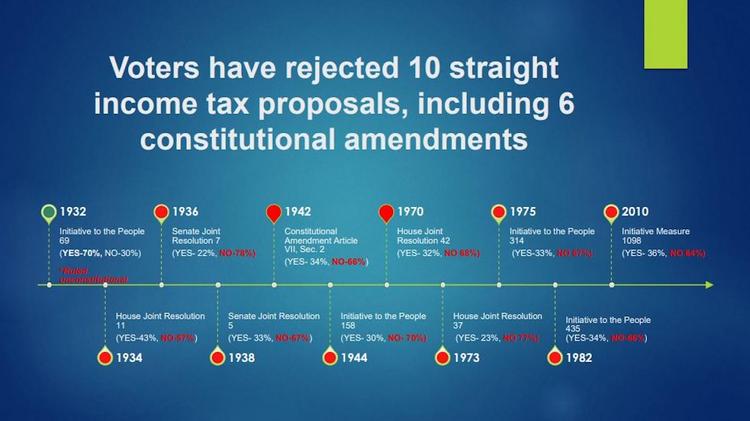

The new law will take effect January 1 2022. Washingtonians have told us several times over the years they do not want any. The CGT imposes a 7 long-term capital gains tax on the voluntary sale or exchange of stocks bonds and other capital assets that were held for more than one year where the profit exceeds 250000 annually.

The repeal side of an advisory vote on a capital gains tax approved by the state Legislature is out to an early lead following Tuesday nights. Voters in Washington state will get their chance to weigh in Tuesday at least symbolically on the controversial new capital gains income. IIC Expenditures None.

Initiative supporters are likely to point to last years tax advisory question in which 61 said the Legislature should repeal the capital gains tax as proof the voters are with them. The answer from voters by a wide margin was no with a vote of 63 to 37. Washingtons legislature passed a new capital gains tax in April Engrossed Substitute SB.

Washington state Attorney General Bob Ferguson. Jay Inslee D signed legislation creating a 7 percent capital gains tax to take effect next yearOn November 2nd Washington lawmakers will learn what voters think about it. Part IIA Brief Description of what the Measure does that has fiscal impact on the Courts No fiscal impact to the courts.

Repealing the capital gains income tax. Last week a Douglas County Superior Court judge heard arguments in a lawsuit challenging the constitutionality of the capital gains income tax. Attorney General Bob Fergusons decision to attempt to bypass the.

The state of Washington enacted a capital gains tax on individuals who recognize gain from the sale of long-term capital assets. 2 statewide ballot with 63 in favor of repealing the tax and 37 in favor of maintaining it the state elections office reported late Tuesday. Former Washington Attorney General Rob McKenna made compelling arguments that seemed to resonate with Judge Brian Huber.

State Measures Advisory Vote No. Advisory Vote 37 was a non-binding question asking voters to advise the legislature on whether to uphold or repeal Senate Bill 5096 passed by the Washington State Legislature in the 2021 session. Washington Advisory Vote 37 was a question to voters on whether to maintain the capital gains income tax increase passed by the Legislature during the 2021 session.

This tax only applies to individuals. On May 4th Gov. 5096 which was signed by Governor Inslee on May 4 2021.

Under a 2007 state law voters must be. A superior court judge recently determined the tax is unconstitutional. This bill would repeal the Washington state capital gains income tax Laws of 2021.

GeekWire File Photo Dan DeLong Seeking to overturn a lower court ruling blocking Washington states new capital gains tax the attorney generals office on Friday asked the state Supreme Court to take up the case on direct appeal. With strong revenue projections and operating budgets already leaping.

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire

Wa Dems Capital Gains Tax Is A Concern For Retirees Tri City Herald

Utah Senate Unanimously Moves To Decriminalize Polygamy Utah The Guardian

Does Your State Have A Corporate Alternative Minimum Tax

Lawsuit Filed To Overturn Washington Capital Gains Tax R Seattlewa

Amid Court Battle Over Capital Gains Tax House Finance Chair Previews Future Reforms Publicola

Repealing The Capital Gains Tax Is A Long Shot Slog The Stranger

Washington State Enacts Capital Gains Tax Beginning January 1 2022 2021 Articles Resources Cla Cliftonlarsonallen

:quality(70)/d1hfln2sfez66z.cloudfront.net/10-07-2021/t_25d6a9fc0f48401fb4bc03335d1c699c_name_file_960x540_1200_v3_1_.jpg)

Video Efforts To Repeal Washington S Capital Gains Tax Underway Kiro 7 News Seattle

During National School Bus Safety Week Officials In Maryland Are Bringing To Light A Problem That Does Not Seem To Be School Bus Safety School Bus Bus Safety

Utah Senate Unanimously Moves To Decriminalize Polygamy Utah The Guardian

Capital Gains The Emergency Clause The Voters And The Courts Washington State Wire

Like Hollywood Washington State Can T Resist Its Sequels Puget Sound Business Journal

State Senate Approves New Tax On Capital Gains R Seattle

Why Advisory Vote To Repeal State Capital Gains Tax Does And Doesn T Matter Mynorthwest Com

Lawsuits Challenging Washington S New State Capital Gains Tax On The Wealthy Seek To Re Rig Our Tax Code In Favor Of The Rich Indefinitely Npi S Cascadia Advocate

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire

Judge Overturns Washington State S New Capital Gains Tax Lynnwood Times